In 1995, Scott Sandford, an astronomer working at NASA’s Ames Research Center, set out to disprove a famous law of nature by showing that one can, in fact, compare apples and oranges. His paper for the Annals of Improbable Research describes heating the two fruits at a low temperature for several days, grinding the dried samples with potassium bromide, and then testing the infrared absorbance of each of the resulting powders.[1]

“Not only was this comparison easy to make,” Sandford concluded, “but it is apparent…that apples and oranges are very similar.”

Multi asset investors, like Sandford, need to find ways of making apples-to-oranges comparisons. As the global economy begins to decarbonise, understanding the carbon footprints of portfolios has become critical to investment decision-making. In this short paper we examine how multi asset managers can accurately assess the climate impacts of different fund management strategies within mixed-asset portfolios.

The Scope 3 challenge

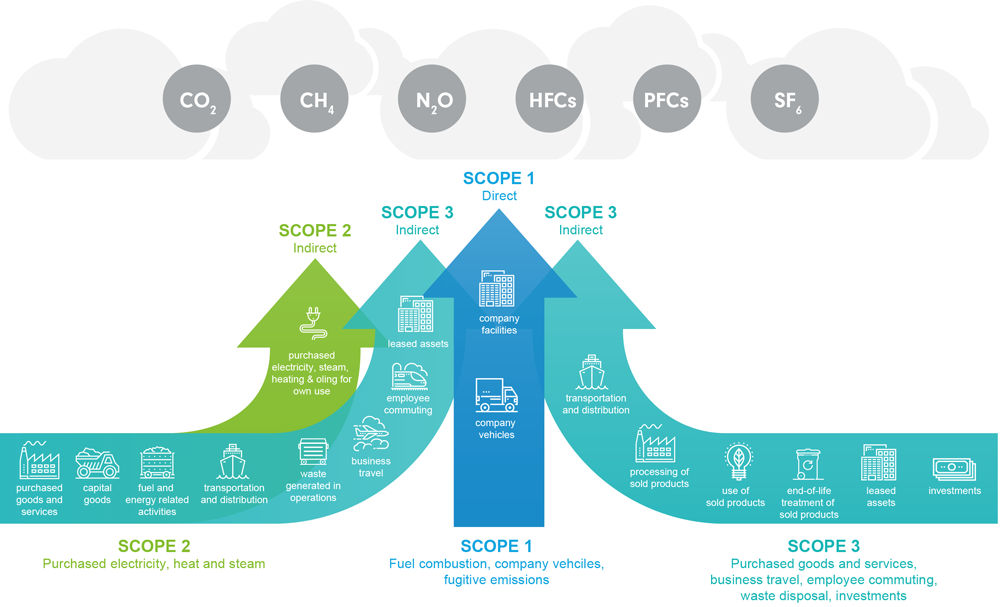

To quantify a portfolio’s environmental impact, we need to measure the greenhouse gas emissions of its constituent companies. The Greenhouse Gas Protocol, a set of globally accepted reporting principles, helps classify these emissions. A portfolio of manufacturing stocks, for example, might require tracking the tonnes of carbon dioxide from companies’ boilers and vehicles (classified as Scope 1 or ‘direct’ emissions by the Protocol), alongside the carbon footprint of their purchased electricity (Scope 2 or ‘indirect’). Thinking more widely, the assessment could include the carbon footprint of companies’ supply chains, including the emissions from contractors (Scope 3, which are also ‘indirect’). Finally, it could include data on the environmental impact of the manufactured products (also Scope 3).

Figure 1: The Greenhouse Gas Protocol classifies emissions across the value chain for reporting purposes

Our ultimate goal as investors is to consider all types of emissions (Scopes 1, 2 and 3) within a portfolio. Unfortunately, Scope 3 emissions are still difficult to measure, open to modelling errors and not frequently disclosed. In March 2020, MSCI reported that just 18 per cent of the constituents of its broadest MSCI ACWI Investible Market Index reported Scope 3 emissions.[2] We expect this will change over time as Scope 3 emissions are the biggest contributor to total corporate emissions, although the balance differs across sectors.[3] Between 1995-2015, Scope 3 emissions grew by 84 per cent, compared to 47 per cent and 74 per cent for Scopes 1 and 2 respectively.[4]

Until Scope 3 data improves, investors must measure what they can. But they need to be fully aware of which emissions are being compared across portfolios, particularly if portfolios have meaningful sector biases. For example, omitting Scope 3 emissions in a portfolio biased to manufacturing stocks, which can have a high share of Scope 3 emissions, risks significantly underestimating its climate impact.

Assessing carbon footprints for multi asset portfolios

For equity-only portfolios, calculating carbon footprints is relatively straightforward. Where carbon data is available at the individual security level, it can be aggregated at the portfolio level. The simplest approach adds the absolute tonnes of carbon emitted across a portfolio’s holdings, pro rata for the share of each company’s market capitalisation held by the portfolio. By this measure, if a portfolio owns 1 per cent of a company, it is responsible for 1 per cent of its carbon emissions. To illustrate this, imagine a simple two-stock portfolio:

This carbon footprint assessment is intuitive: it makes a direct link between invested capital and emissions, enabling apples-to-apples comparisons. This approach won’t work, however, for multi asset portfolios that include bonds. Emissions could be attributed according to the portfolio’s share of an issuer’s overall borrowings, but this flatters companies with large pools of debt, as it spreads emissions over a larger base. If a company were to issue more debt, the total portfolio’s share of emissions would fall, without any changes to the company’s environmental practices. Moreover, if a portfolio holds both equity and debt in the same company, this method would double count the carbon.

An alternative method is to attribute emissions according to a portfolio’s share of an issuer’s enterprise value. Enterprise value is the combined market value of a company’s equity and its net debt. However, this approach runs into difficulties where debt issuers do not have listed equity. It is also volatile: equity and debt values change with financial markets.

Perhaps most significantly, this metric has very limited use when comparing funds to one another and to their benchmark indices. By linking carbon emissions to capital ownership, large portfolios will necessarily have a higher carbon footprint than smaller portfolios that hold the same securities, making direct comparisons impossible.

Using weighted average carbon intensity

Another solution is a measure called ‘weighted average carbon intensity’. First, calculate the carbon intensity for each underlying holding by dividing each company’s annual emissions by its annual revenue. This is expressed as tonnes of CO2 emitted per million dollars of revenue (tCO2e/$m). This scales or normalises each company’s emissions by its sales. Then each holding’s carbon intensity is adjusted according to its weight in the portfolio. Finally, the weighted carbon intensity of each holding is added up to get the weighted average carbon intensity for the portfolio.

To return to the two-stock example from above, the weighted average carbon intensity would be:

This approach is applicable across equity and fixed income investments, and allows for cross-portfolio comparison because a weighted average is unaffected by the overall size of a portfolio. It helps multi asset analysts identify holdings and sectors that need attention, and supports engagement with underlying managers.

Context matters

Calculating carbon intensity is a useful tool, but it can distort the picture for some sectors. For example, utility companies’ revenues will typically rise as the market price for energy rises. Therefore, utilities could report falling carbon intensity, independent of any change in business practice, due to fluctuating power markets. It may be more meaningful to look at emissions per gigawatt hour of generation, instead of sales. Similarly, other sectors might scale emissions by different measures such as number of employees or customers, or the size of their real estate floor space.

Analysis should be more than mathematical lever-cranking, however. We use qualitative discussions with underlying managers to put these kinds of quantitative measures into context and build a more complete, forward-looking picture of a portfolio’s climate risks. This approach offers two specific benefits:

1. It helps assess whether a manager’s claims match reality.

Our analysts can dig into the security selection process to assess whether a manager will act on professed commitments and has a thorough, repeatable process for understanding a portfolio’s climate impacts. For example, an analyst may ask if a manager researches the carbon intensity of different business lines or tests the rigour of companies’ emission targets. A manager’s track record of holding firms to account over targets is also important. Such discussions often highlight changes in climate risks before they show up in emissions reporting for the previous financial period.

2. It incorporates a range of climate risks.

Analysts can use discussions with managers to differentiate the risks facing portfolios with similar weighted average carbon intensities. These risks are broken down into physical, regulatory and financial:

Physical risk: Portfolios will have varying exposure to physical risks, such as extreme weather events, the changing availability of natural resources, and declining land values. These will differ with portfolios’ geographic biases, sector tilts, and the expected life of physical assets, including fossil fuel reserves. These measures are key to comparing portfolios’ overall climate risk but will not necessarily show up in carbon intensity measures. Analysts can test portfolio resilience by raising specific risks with underlying managers to see if they have modelled relevant scenarios and reflected any vulnerabilities in valuations and security selection.

Regulatory risk: Portfolios with different geographic footprints carry different policy risks, even if their overall carbon intensities are comparable. At the extreme, certain assets such as coal-fired power stations or oil fields may become stranded due to changing government rules or market demand. Analysts will not only discuss these risks with managers but expect them to be reflected in security valuations, the sizing of holdings within the portfolio, and any engagement with company executives.

Financial risk: Some companies may be more susceptible to climate risk due to their balance sheet and market position. For example, holdings with weak pricing power, perhaps due to lack of customer loyalty or elastic demand, will be poorly placed to share cost increases due to climate change. Similarly, companies with tight operating margins and large carbon-related input costs might be most affected by rising costs, all else being equal. Here too the right research, security selection, and position sizing can add value by mitigating risks and identifying climate leaders.

Conclusion

Counting carbon emissions is essential to being able to reduce them. Emissions reporting has steadily improved in recent years, but Scope 3 disclosure needs to be ramped up to give investors a full picture of the risks a particular company, sector or portfolio faces. Quantitative measures such as weighted average carbon intensity can help investors compare different strategies and portfolios - just as Sandford did with fruit - but need to be viewed in the context of detailed conversations with managers in order to identify the latent, but material, climate risks and opportunities across multiple asset classes.

This article is the first in a series of pieces about sustainability in multi asset investing. Others will cover different aspects of the team’s research into sustainability within and across asset classes, and its impact on manager selection.

[1] Sandford, S. (1995). Apples and Oranges: A Comparison. Annals of Improbable Research, 1(3), Available at: https://www.improbable.com/airchives/paperair/volume1/v1i3/air-1-3-apples.php [Accessed 4 May 2021].

[2] Baker, B. (2020). Scope 3 Carbon Emissions: Seeing the Full Picture. Available at: https://www.msci.com/www/blog-posts/Scope-3-carbon-emissions-seeing/02092372761 [Accessed 4 May 2021].

[3] Corporate Value Chain (Scope 3) Standard. Available at: https://ghgprotocol.org/standards/Scope-3-standard [Accessed 4 May 2021].

[4] Hertwich, E. and Wood, R. (2018). The Growing Importance of Scope 3 Greenhouse Gas Emissions fromIndustry. Environmental Research Letters, 13(10), p. 5. Available at: https://iopscience.iop.org/article/10.1088/1748-9326/aae19a [Accessed 4 May 2021].