The ‘G’ in ESG

For bond investors, who lack a shareholder vote, covenants are the ‘G’ (or corporate governance) in ‘ESG’ (which also covers environmental and social criteria). Covenant documents form the legal rights for bondholders to protect and ensure that a company’s cash flow is targeted appropriately towards the interest payments (coupons), and the ultimate redemption of its bonds.

Bond covenant quality is closely related to the market cycle and we can often pinpoint where we are in the cycle by following the trend of covenants. Starting with the market cycle, we can get a sense of why covenants are changing, and then highlight some of the most important changes which investors should be aware of, and the mitigating actions they can take.

Taking the bond market temperature

Corporate default rates are low and not far off the lowest they have been since the crisis (chart 1). In the US and UK, bond spreads are the tightest they have been since the crisis, and in Europe they are not far away (chart 2). A simple explanation of this would be that because default rates are low, spreads are low. But there’s more to the story.

.

.Corporate leverage is rising in both the US and Europe, and across the capital structure in investment grade and high yield bonds (chart 3). Part of the reason why default rates are so low is that companies have taken advantage of historically low borrowing rates to refinance and push out bond maturities (chart 4).

Reading the signals

All these signs - low default rates, tight spreads, rising and high leverage, and longer bond maturities - are clues that we are in a late cycle stage. At this point in the cycle, investors become increasingly impatient in their search for yield, and relative power begins to shift towards issuers, who in turn start relaxing covenants. Since 2011, covenant quality has been deteriorating, pausing in 2016, but then resuming its path in the first half this year (chart 5).

Europe’s rising leverage is following in the footsteps of the US where animal instincts have been alive and kicking for some time. Increasing M&A, large-scale buybacks, and rising private equity involvement in the market are leading to demand for financing from the bond markets, resulting in higher corporate debt levels.

The problem is that spreads are not compensating for the additional risk inherent in increasing leverage. After taking into consideration historical loss rates, the excess spread today is small, and for the lowest-rated bonds it is negative (chart 6).

.

.At this stage in the cycle, it’s crucial for investors to know how covenants are changing so that they are aware of the risks they are taking. In addition, default rates will not remain this low forever, so credit selection is paramount. A combined approach of picking the bonds with the strongest fundamentals, and understanding and monitoring covenants, which are meant to protect investors against overly risky behaviour by issuers and in the event of defaults, will place investors in the best position as this cycle matures.

Covenant package deterioration

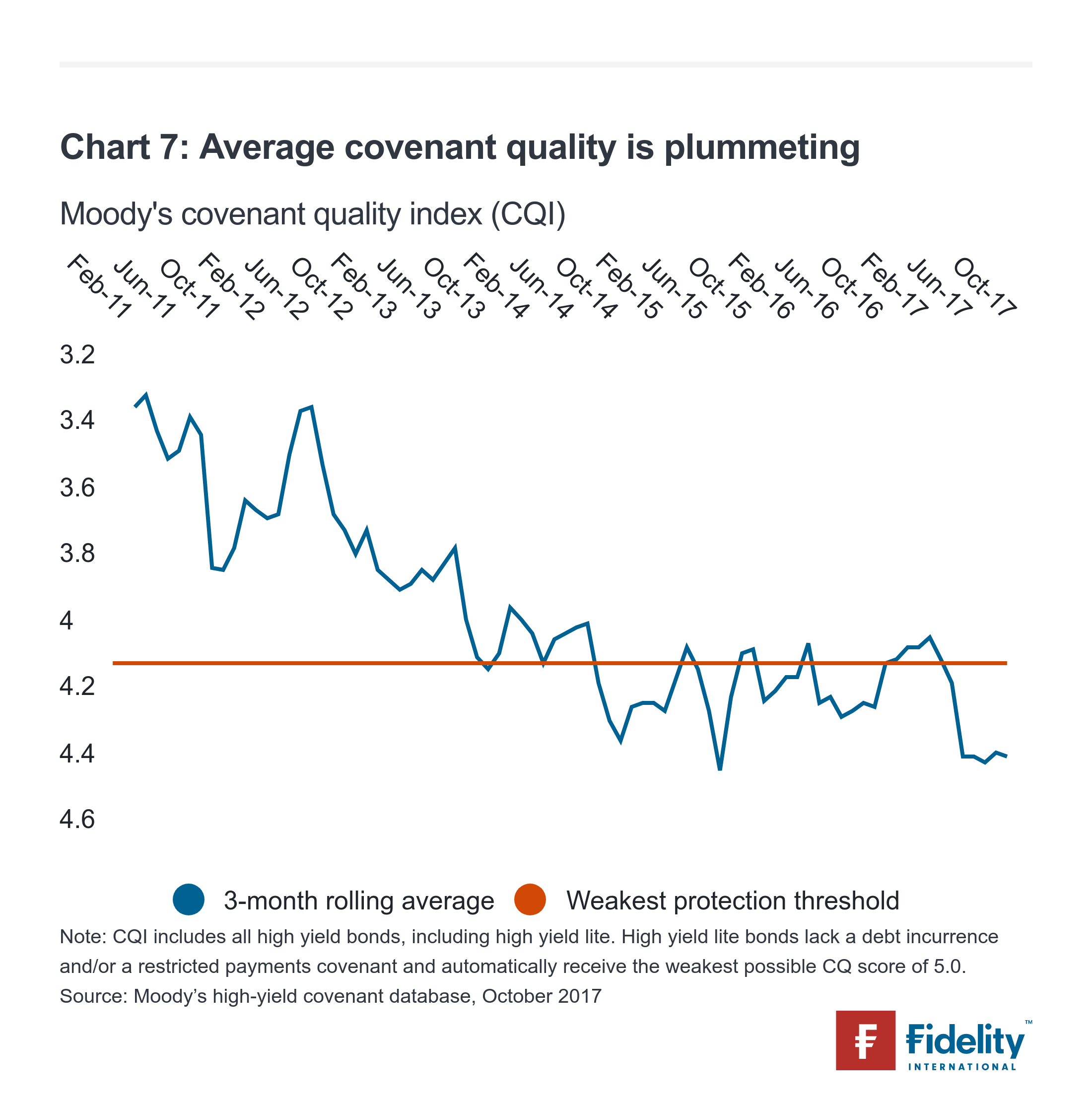

Covenant packages as a whole have been deteriorating for some time. Moody’s index of covenant quality recently measured close to its worst reading ever, even as coupons, which are intended to compensate for risk, have continued to fall.

Some of the overall decline can be explained by the increased issuance of ‘cov-lite’ bonds, which by definition have less covenant protection. Yet this year, Moody’s average score for new bond issuances containing the ‘full suite’ of high yield covenants reached their weakest level since 2015 (chart 7).

.

.Most covenant elements have been eroding over the past couple of years. In recent months, it has been particularly pronounced in provisions governing restricted payments and the often overlooked calculation of certain ratios.

‘Full suite’ would be expected to feature covenants providing protection to noteholders with respect to the following corporate actions: indebtedness, liens, restricted payments, affiliate transactions, dividend and other payment restrictions, sale/leaseback transactions, asset sales, sales of restricted subsidiaries, future subsidiary guarantors, merger/consolidation and disclosure.

Restricted payments

In their simplest form, restricted payments clauses limit the issuers’ ability to make payments outside the credit group, such as dividends, distributions, certain investments, and equity or subordinated debt redemptions and repurchases. These provisions are intended to trap cash and assets within the credit group of an issuer to, among other things, maintain its ability to repay noteholders and preserve its assets in case the company becomes distressed.

Recently issuers have attempted to continue the loosening of restricted payments covenants in three key ways:

- including a leverage-based permitted payments basket, which permits unlimited leakage of cash as long as the company meets a specified leverage ratio is met;

- allowing for unlimited restricted payments in connection with certain changes of control provisions; and,

- permitting significant leakage via increasing ‘permitted investments‘ in unrestricted subsidiaries.

Leverage-based permitted payments

In the first half of this year, roughly 70% of European high yield bonds featuring the ‘full suite’ of standard high yield covenants have contained a leverage-based permitted payments basket. This is a significant jump from the 61% figure a year ago.1

This basket permits companies to make unlimited restricted payments so long as they continue to meet a specified leverage ratio. This allows capital, and/or assets, to flow out the door, decreasing the amount of cash available to pay bondholders their coupon and principal and potentially leaving bondholders with access to fewer assets in the event of default.

In addition, the specified leverage ratios are increasingly set above issuers’ opening leverage ratio on the issue date. The original purpose of the unlimited restricted payments basket was to reward companies for deleveraging by setting specified leverage ratios at lower levels.

But by setting the specified leverage ratio above the opening leverage level of the issuer, issuers have immediate use of this basket.

Permitted payments related to change of control provisions

Historically, bondholders have had call protection in the event of a change of control. For some time now, companies have been able to potentially escape triggering this call right through including portability provisions. Recently, there have been a number of private equity-backed deals, which have proposed including a permitted payments basket that allows unlimited restricted payments made in connection with a change of control transaction.

Permitted payments in connection with change of control transactions essentially suspend the restricted payments covenant when a change of control occurs so long as the issuer can meet the conditions to use the basket. Our concern is this would provide the issuer, and its private equity sponsors, the opportunity to make payments or dividends to itself solely because it is selling the company to a new owner, allowing leakage without having had to ‘earn’ such dividends via the builder basket or having to make an offer to repurchase the notes at 101% of par.

Permitted investments in unrestricted subsidiaries

‘Permitted investments‘ in an indenture are a list of specified investments that are exempt from the restricted payments covenant. In this late-cycle stage, permitted investments are becoming substantially more flexible, posing challenges for investors.

One particularly egregious problem has occurred in a few recent transactions where the issuer attempted to include a permitted investments basket, which allowed unlimited investments made by non-guarantor restricted subsidiaries as long as the investments were financed with proceeds received in a way permitted under the restricted payments covenant. Although this may seem like an obscure point, it has major implications.

Given that virtually all high yield bond agreements allow unlimited investments by issuers in any restricted subsidiaries (including non-guarantor restricted subsidiaries), the inclusion of this ‘non-guarantor restricted subsidiaries investments’ basket makes it easy for companies to move cash and assets into non-guarantor restricted subsidiaries, which in turn can invest these amounts into unrestricted subsidiaries outside the credit group. Once cash and assets are invested in unrestricted subsidiaries, they are no longer governed by the covenants, so this basket provides an opportunity for effectively unlimited leakage.

Issuers have attempted to include this ‘non-guarantor restricted subsidiaries investments’ basket in the past but were unsuccessful due to strong investor resistance. It has now reappeared in a few recent deals. One again investors seem to have been successful in pushing back, but they must remain vigilant.

Builder basket: this basket ‘builds’ capital through retained excess cash flow or from a fixed percentage of net income. The proceeds can be used for restricted payments, such as dividends, distributions, certain investments, and equity or subordinated debt redemptions and repurchases.

Unrestricted subsidiaries: consolidated subsidiaries of the issuer who are not subject to the covenants governing the issuer’s bonds.

Non-guarantor restricted subsidiaries: subsidiaries governed by the terms of the indenture but which do not directly guarantee the notes issued in relation to the indenture.

Calculation of ratios

Date selection

A key tool for investors to monitor the health of a company, and their investments, is financial ratios. In addition to investors using the ratios, the level of restrictions under a number of covenants in an indenture is determined by whether the company is above or below certain financial ratios. For example, the ratios may determine how much additional debt a company can incur or whether there is any capacity to make restricted payments outside the credit group.

How these ratios are calculated exactly is prescribed in the indenture, and can have a large bearing on how much flexibility the issuer has in operating its business - so the integrity of these calculations is crucial.

Recently, issuers have been introducing increasing flexibility into the terms of how they calculate their ratios. One method gives issuers flexibility in the date they use for calculating when certain debts are incurred. Typically, an indenture will permit a company to calculate its leverage ratios and/or fixed charge coverage ratios on either the date the company enters into a commitment or the date the amount is actually borrowed.

Issuers are increasingly expanding this right to select the date option, to include the ability to reverse its date choice ‘at any time and from time to time’. This clause effectively authorises the company to game ratio calculations depending on what is best for the company at that particular time.

Calculation transparency

The problem doesn’t end there. The issuer is only required to provide limited transparency to noteholders regarding which date is being used on which occasion. This makes independent verification of ratios more complicated, and it makes it more difficult for investors to challenge the issuer on whether an action taken by the company breaches its covenants.

This seemingly small date nuance has a large impact given that leverage and coverage ratios permeate throughout the covenant agreement, with many other clauses containing restrictions dependent on these calculations. Perhaps most importantly, ratios are used to determine what the company can do under its indebtedness and restricted payments covenants, and whether there is portability in a change of control transaction.

The amount of indebtedness a company can incur under the indebtedness covenant (other than where a permitted debt basket is available), is dependent on whether the company can meet the specified fixed charge coverage ratio or leverage ratio.

Additionally and as previously mentioned, many high yield bonds contain a permitted payments basket allowing unlimited restricted payments as long as the company continues to meet the specified ratio (after giving pro forma effect to the payment).

Finally, upon a change of control, bondholders traditionally could exercise a put option to sell their bonds back to the issuer at 101% of par plus accrued interest, protecting investors from having to hold bonds when a highly levered new owner, or an owner with an unknown track record, buys the issuer.

This right has been increasingly weakened by the rise of portability over the past few years. Portability allows the issuer to escape repurchasing bonds in a change of control transaction if certain conditions are met.

By making it difficult to determine how a company is calculating its ratios, it makes it harder for bondholders to challenge issuers when the latter uses its ratio-based debt capacity to incur debt or its ratio-based permitted payments basket to make dividends, investments or other restricted payments. Where the bonds have portability, if the issuer has flexibility over the date used for the leverage calculation, it might be able to game the calculation to avoid repurchasing the bonds, leaving the bondholder exposed to a lower-quality company.

Portability: when bonds have ‘portability’, it means the traditional put right is only available if, in addition to the change of control, the company either(1) does not meet a specified leverage ratio after giving pro forma effect to the transaction, (2) the company is downgraded by specified ratings agency(ies) or (3) in some case both (1) and (2).

How bondholders can protect themselves

While the balance of power in covenant agreements swings away from bondholders towards issuers, there are certain actions that investors can pursue to protect themselves.

Expert interpretation and collaboration

Bond offering memoranda can run into hundreds of pages and are filled with legalese. These documents establish the legal rights for bondholders and investors need to be clear on how they will be treated under different scenarios, and their avenues of recourse.

It is important to pay close attention to a company’s limitation on indebtedness, particularly which corporate assets are provided as security for bondholders, and whether companies can incur indebtedness at operating companies to structurally subordinate the bonds.

This time-consuming work requires skilled, experienced and dedicated legal resources who can fully understand, interpret and communicate the technical language contained in the bond documents.

No one individual is going to be able to master all the diverse skills required to effectively invest in bonds throughout the market cycle. It needs teams working across divisions who can interact seamlessly.

Credit analysts are the central figures but they need ready access to expert legal opinions, and they need to work with equity analysts to build a more comprehensive understanding of a company. Portfolio managers have to lean on all these skillsets at very short notice.

Push back

It’s often necessary to engage issuers and sometimes push back on terms. This is not easy, and requires credibility with the issuer and the capacity to engage in resource-intensive negotiations. Investors must commit to lengthy, ongoing, time-consuming discussions, and be strategic in their dealings with the issuers.

Investors also need to engage with other investors and discover points of agreement and ways to combine efforts effectively. Investors can participate in industry groups and standards boards, and by liaising with market regulators it is possible to promote bondholder interests more generally and establish a voice over time.

One good example is the recent Diversey high yield bond issuance. During the roadshow Fidelity, along with investors across the buy side, pushed back against the inclusion of a permitted investment basket that created a potentially unlimited capacity to make investments outside the credit group. The result was the removal of the offending permitted investment basket in the final documentation.

Abstain

There are times when investors are unable to convince issuers to remove egregious terms from their covenant packages. In these situations, the only option is to refrain from making the investment, either entirely or to wait until the price declines to a point where the yield on the bond is high enough to compensate for the risk created by the loose covenant package.

A case in point is the recent HEMA bond issue. We chose to refrain from investing in HEMA due to several factors; one of which was the flexibility granted to the company to calculate its financial ratios, and the lack of transparency for investors in how those calculations are made.

Conclusion

Bond covenants are an essential line of defence for bondholders. The gradual erosion we are seeing in their standards not only signals the maturity of the cycle, but also indicates that investors need to adapt their approach to bond investing.

Much of the trend in watered-down bond covenants is being driven by private equity, which has large pools of capital deployed in the market. Dry powder is approaching $1 trillion, the highest it has ever been.2 As this money starts entering the market, covenants could corrode further.

Investors must monitor much more closely how bonds are performing and whether they are fulfilling their covenant requirements. This is time-consuming work but becomes increasingly important as more capital enters the market and the cycle grinds towards its peak. Covenants will become increasingly important in guarding investor interests.

Despite the pressures on covenant quality, we are still seeing good opportunities for investment in the bond market, but those opportunities require more due diligence and discretion. More now than ever in this cycle, fundamental analysis should be complemented with a thorough review of covenant agreements to ensure the best outcome.

References

1. Xtract Research, European High Yield 2017 Half-Year Review, 3 August 2017

2. $906 billion; Prequin Q2 Private Equity & Venture Capital report