The big lesson of 2021 is that a reopening cycle is not like a normal cycle. Things happen faster, sometimes in unanticipated ways. As we head into 2022, this week’s Chart Room takes a look back at the year in charts that helped us form a view on the great question of the past 12 months: how ‘transitory’ is inflation?

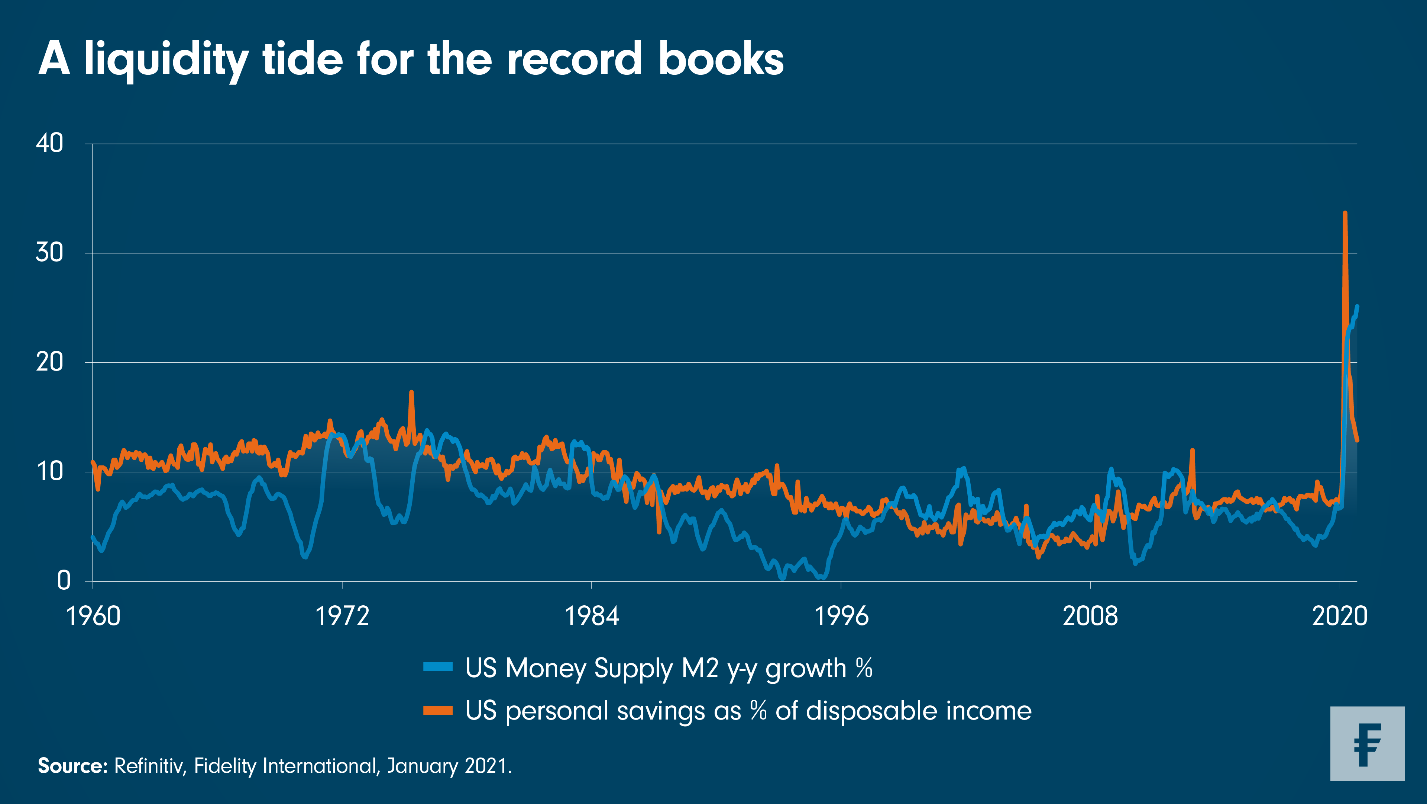

The year began with the financial system awash with liquidity.

Policymakers’ pandemic response the previous year had led to new high-water marks in the US for money supply growth, which rose by 24 per cent in 2020, the biggest increase since records began before the Great Depression. The US personal savings rate was also elevated, having hit a peak of 33.7 per cent at the height of the initial lockdown in April 2020.

As Steve Ellis, Fidelity International’s Global CIO, Fixed Income wrote in January: “This flood of dollar liquidity is seeping into all aspects of asset markets, and the impact is overwhelming in the absence of real productive utilisation in the economy.”

The likely consequence?

“I expect inflation will rear its head in 2021.”

And so it did. By April, the US consumer price index was up 4.2 per cent year on year, the highest inflation rate since 2008. But wait, there was more.

While there was much talk at the time of these headline numbers being transitory in nature, most notably by US Federal Reserve chair Jerome Powell, the bottom-up view from Fidelity analysts was telling a different story, especially for non-labour costs.

“Concerns about raw material inflation and supply chain bottlenecks (especially for semiconductors) have certainly increased,” noted one industrials analyst back in May.

Labour costs were also rising, especially in the energy sector as workers sought jobs in other industries. One analyst covering North America pointed to “truck drivers who used to work in oil but now drive trucks for online delivery companies”. Driver shortages would not be confined to North America, as UK motorists who queued to fill their cars in September would attest.

The conclusion we drew from May’s analyst survey was that “inflationary pressures were likely to persist into the summer and beyond”.

Not helping matters was the strength of China’s currency, the renminbi, which hit a three-year high against the dollar in June.

This was more than a weak dollar story. It also reflected divergent monetary and fiscal policy between the world’s two biggest economies, with China, first in and first out of the pandemic, normalising policy while US authorities remained in supportive mode. The stronger renminbi pushed up prices faced by those buying China’s exports, adding to inflationary pressures. By December the Chinese currency had risen further, reaching its highest level against the dollar in three years.

That was before considering the logistical difficulties which emerged in 2021 around getting goods from suppliers to customers. The yellow line on the chart below, from August, which is on an inverse scale, shows how delivery times have crept up in 2021, hitting levels not seen since the mid-1970s (a higher reading indicates slower deliveries).

These supply chain bottlenecks have been another factor pushing up prices in 2021, and a particular feature of the reopening cycle. And while bottlenecks may have abated in some areas, they are having some lasting effects. Difficulties sourcing semiconductors, for example, have led to managers prioritising strategic stockpiles over just-in-time inventory models, evidently viewing the extra cost as worth paying. We are also beginning to see evidence of pricing power among some companies, such as those in the tech hardware sector. While this is positive for those companies’ margins, it suggests further upwards pressure on inflation in the year ahead. So too do longer-term factors like rising labour costs in lower-wage sectors, the costs associated with the net zero transition, and strong demand for US housing that is set to outstrip supply.

Small wonder then that policymakers have backed away from the ‘transitory’ mantra, and as of December, Fed chairman Powell has retired the term. This seems appropriate as inflation is likely to persist in 2022 in certain sectors as supply-side struggles to meet demand and the ongoing pandemic cause further disruption.